If someone told you it’s possible to claim back some money which you had spent while shopping in Paris, would you? Surprisingly enough most think it’s too much effort to fill in a few forms before you leave the country for a French VAT tax refund.

What is French VAT TAX

VAT Tax is actually paid in over 140 countries around the world and is similar to GST or Sales Tax. In English VAT stands for (Value Added Tax) in French it’s translated to (Taxe Sur La Valeur Ajouttée) VTA.

This tax is usually included in the price on the label and is not added once at the cash register. The VAT tax can range from around 2% for medicine and drugs to 33% for luxury goods at this current point in time. It’s typically added onto goods and services to raise money which will helps fund the French government’s budget needs.

Who Can Claim VAT TAX Refund

In order to be eligible for a VAT tax refund there are a few requirements that must be met.

- Spend more than 175€ in the same store, same day

- Can’t be a member of the European Union

- Older than 15 years of age

- Acquire a valid Customs stamp upon departure of the EU

- Within 3 months of purchase your items should be exported

- Residing in France for less than 6 months

What Items Can You Claim

Refunds can only be claimed on goods which are a retail purchase and they must not be acquired for commercial reasons. Here is a list of goods which are excluded from the VAT refund;

- Items which have already had the VAT tax removed for promotional reasons

- Manufactured tobaccos

- Petroleum Products

- Postage stamps

- Weapons

- Cultural items

- Private means of transport

How To Claim VAT TAX

As with most things in France there is a little bit of paperwork involved. Once you have made your purchase of more than 175 euros you will need to acquire a VAT “Detaxe” Form. Most stores will have a copy of this form however it is possible to get a copy at the French airport from where you are exiting the EU.

Large retailers such as Galleries Lafayette and Printemps have a designated VAT refund desk or office’s where you can acquire and process the Detaxe form. Processing your transaction at a refund counter means that you can get money back immediately if all eligibility requirements have been met. You will still need it stamped by customs and put in the mailbox within 6 months of purchase or possibly face a fine. Here is a list of many shops and malls in Paris which offer duty free shopping and tax refund counters.

Steps to take to acquire a refund without the stores mentioned above are;

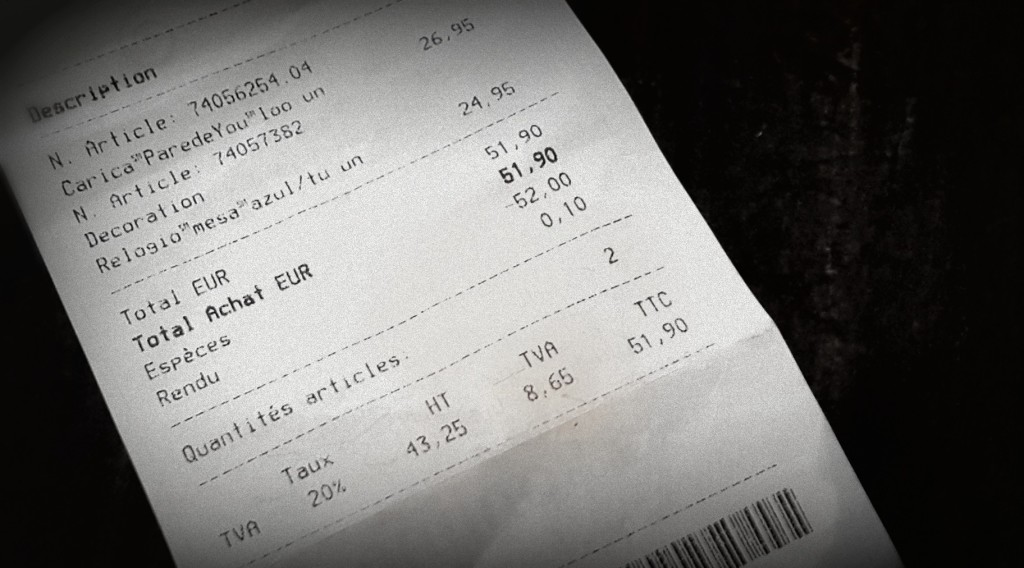

- After a purchase of 175€ or more acquire the VAT refund form and keep the sales receipt.

- Before airport check in, complete the form and have it stamped by a customs officer at one of the airport locations listed below.

- Find a post box in the airport and send off the de-tax form

- WAIT, WAIT, WAIT… you can expect a check via mail or direct deposit into a chosen bank account however France takes a lot of time to process anything.

- Train stations may not have a customs office so you will have to use third party companies such as Global Refund or Premier Tax Free to claim your refund. These companies will take pre-determined commission of your refund.

Paris Airport VAT Refund Office

Charles de Gaulle Airport

Terminal 1: CDGVAL level, hall 6

Terminal 2A: Departures level, gate 5

Terminal 2C: Departures level, gate 4

Terminal 2E: Departures level, gate 8

Terminal 2F: Arrivals level

Terminal 3: Departures level, airside

Orly Airport

West Terminal: Arrivals level, gate E

South Terminal : Departures level, gate G

Forgot To Lodge The Form?

If you forgot to lodge your VAT refund form before you left Paris then you will have to send a request to for tax refund to the “French Customs Ataché” within 6 months of your purchase.

For most travellers this step will not be worth the time and effort it takes to acquire a refund. The application involves a trip to the French consulate for an attestation of merchandise, a letter with good reasons why you did not lodge the form before leaving France, a retail export form, copy of boarding pass and appropriate identification. All of this may not be worth the trouble of possibly getting a few dollars in returns.

Food For Thought – Customs

Be wary of customs regulations and required taxes which should be paid for purchases over a certain denomination in country that you are returning too. Each country is different, for example the USA has a 3% tax on goods which were purchased outside of the country and valued at more than $1000 USD. (This tax denomination may change over time and is only a ballpark figure for general purposes.)

With all that said and done only you can decide if a VAT tax refund is worth the effort of dealing with the rigmarole of French paperwork. A 175€ purchase may possibly warrant a refund of 21€ if you’re lucky.

Your Wont Find Anything Like It!! By adding your email you will receive a free copy of our Ultimate Guide of Free Things To Do In Paris eBook. You will also receive exclusive offers and a monthly newsletter. We will not share you email with anyone else!

Dear Sir / Madam,

I have filled up my tax refund form at the kiosk provided in the shopping mall (Printemps)and have it stamped at London airport before flying back to my home country.

I have requested for the tax refund to be credited back to my credit card. May I know how long will the refund process take?

I hope to hear from you soon, thank you.

Honestly im not sure as the french system varies alot and they are well known for being an extremely slow country at processing any paper work so i wouldn’t hold you breath for anything to happen quickly. however myself and the other readers would be very interested to know about the turn around time from you when it happens. Good luck…

Hi, I am in Paris and will b taking a train to Switzerland. May I know how to claim back my tax refund to be exact. Thanks.

I would suggest making sure you do it before you leave the country as it is always harder from outside the country. however as for your specific situation im afraid im not sure exactly where you can do it or if there is a refund location near the train stations. If you do find out a good location please let us all know. Good Luck